What can Agtech learn from the success of Fintech?

“Financial technology” or Fintech has dramatically changed the way that consumers and businesses interact with their finances. But before Fintech went mainstream, Fintech companies had to overcome heavy regulation, a market dominated by incumbents, and a landscape of closed services. How were these companies able to launch products and win markets in an industry as challenging and crowded as finance? “Agriculture technology” or Agtech companies today face challenges similar to those that Fintech companies have overcome in the past decade. By studying the lessons learned in Fintech, Agtech companies can better navigate the challenges of the agriculture industry and accelerate the success of Agtech.

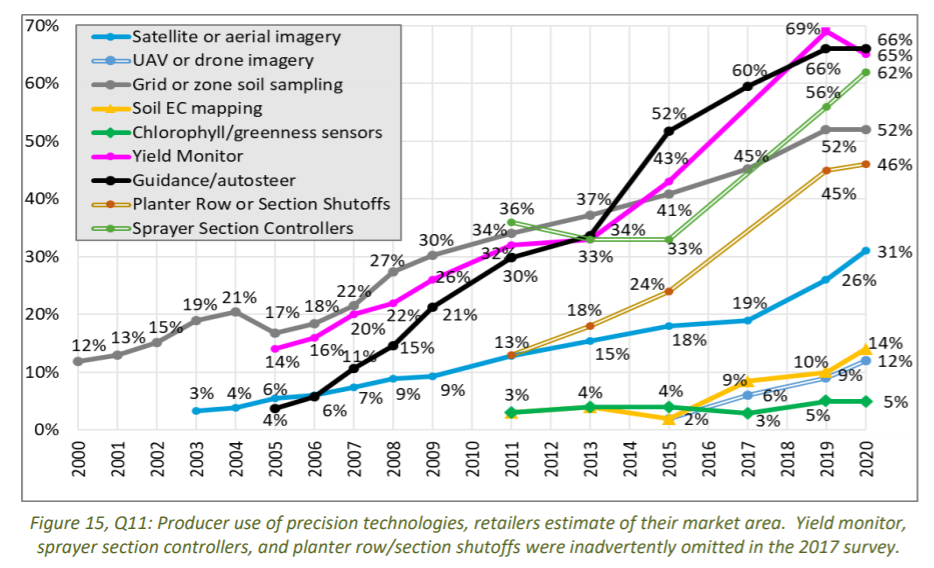

For context, a 2019 EY Fintech report shared that the global adoption of fintech services has grown from 16% in 2015 to 64% in 2019. During the same period, Agtech has also seen increasing adoption in agriculture. A 2020 CropLife/Purdue Precision Agriculture Dealer Survey reported adoption rates over 60% for certain technologies like machine data collection and increased usage for other technologies.

Despite the promising growth, Agtech adoption is still nowhere near the scale of Fintech’s adoption and Agtech companies have yet to reach the growth or mass adoption as independent companies in the way that Fintech companies have. Agtech companies have also not yet been able to create or capture the same amount of value as Fintech companies. Why?

It is important to note that there are fundamental differences between the two industries that contribute to this discrepancy. First, Agriculture is almost always B2B while Fintech companies can have both B2B and B2C models. Second, distribution at the farm level is a unique and difficult challenge that better resembles sales to small businesses than to consumer or enterprise.

Despite these differences there is still much regarding product, go to market, partnerships, and marketing that can be learned from Fintech’s success and implemented by Agtech companies to help accelerate their growth.

Here are four lessons from Fintech to consider:

1. User experience (UX) as a competitive advantage.

Forbes reported that one way Fintech is outcompeting traditional banking is by viewing design as a methodology, not a package. Keeping customer experience as the focus helps Fintech to think about banking services as a whole, user-friendly ecosystem. Apps such as Venmo have turned a mundane process of money transfer into a fun way to pay your friend or family member. B2B Fintech companies like Brex and Ramp have also focused on providing an intuitive user experience which is a significant upgrade from traditional banks and allows them to compete with the large institutions.

Has Agtech delivered delightful experiences to growers and agriculture companies? Is there more room for Agtech companies to use UX as a competitive advantage?

2. Improve existing but outdated services.

Fintech applications have succeeded by focusing on improving existing but uncomfortable services. Robinhood is an example of an app that takes a well established business - a stock brokerage, and wins market share by offering a more accessible service than traditional firms with features such as no-fee trading, simple UX, and instant trading. In other words, Robinhood’s fundamental business is the same as traditional stock brokerages (and even built upon the same services) but they are able to win significant market share by providing an easy and frictionless experience.

Square offers a similar example. As financial analyst R. Christopher Whalen notes, “Square in fact is an overlay of off-the-shelf tools and functionality that operates atop the legacy world of banking and payments.” In other words, Square is providing a familiar service with the same infrastructure as everyone else, but they are winning market share by offering a significantly improved solution to old problems.

Fintech companies have been able to win large markets by improving existing but uncomfortable services with frictionless and customer oriented business models, user experience, and distribution. Has Agtech focused on improving the many outdated and uncomfortable services in agriculture or on building entirely new categories? There are good examples of companies pursing both strategies, but there are still many outdates services ripe for improvement in agriculture.

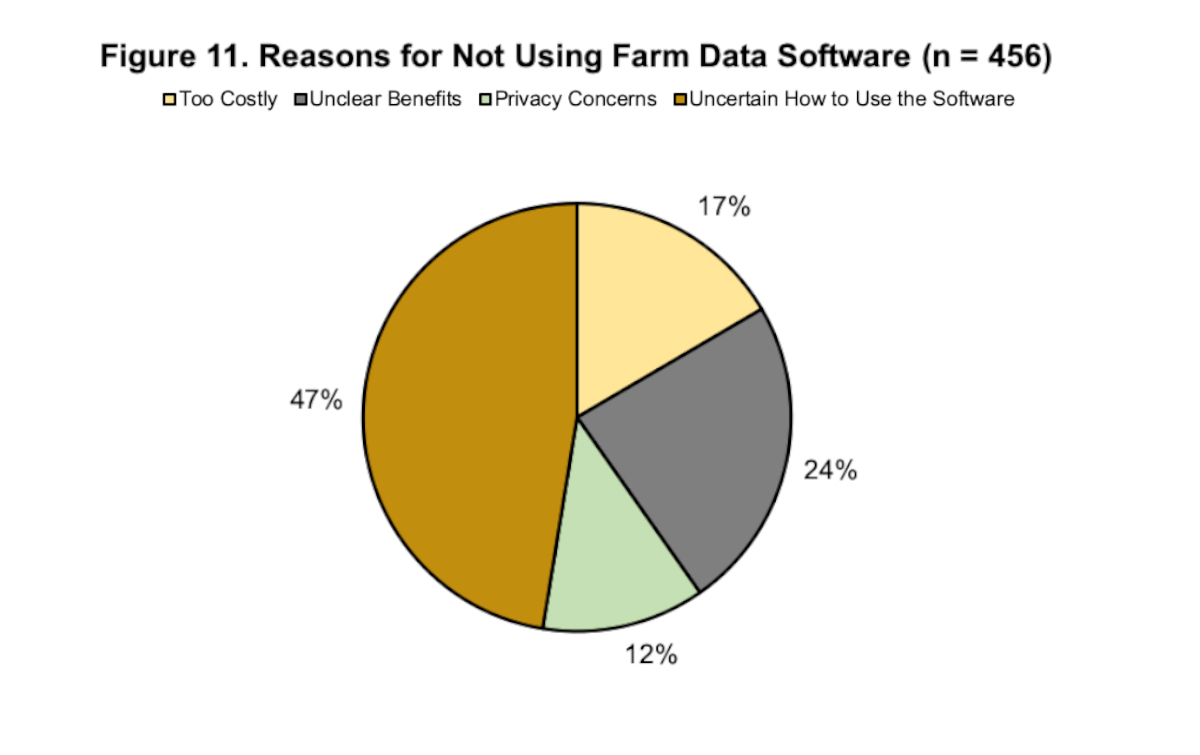

3. Trust and value are prerequisites for sharing data.

Index reports that a continued need from Fintech developers is an emphasis on programming with data privacy and security in mind. The same can be said for Agtech. Growers and their advisors are well aware that their farm’s data is valuable and in the wrong hands it could be misused without their permission. American Farm Bureau Federation reported that “nearly 76% of [grower] respondents said they were concerned others could use their information for commodity market speculation without their consent.” In both industries trust and value are key to the long term success of services that rely on user permissioned data.

When a foundation of trust built on data privacy and security is present, the results are impressive. EY Fintech reports that “Among Fintech adopters, 48% are willing to share their bank data with other organizations in exchange for better offers. Similarly, Purdue University reports “Over 70% of farms are willing to share their data with an outside service provider — most commonly agronomists and ag input suppliers.” They also found that “Farmers are more likely to closely follow recommendations generated by their ag data software than those provided by outside service providers” which highlights the opportunity available if growers trust their software partners.

As both industries work to further adoption, they are challenged to continue to establish trust with their users and deliver higher value services. Do growers and agriculture companies trust the Agtech companies serving them? Do trust and value impact the adoption of Agtech services today?

4. Build with existing tools to boost velocity and win markets.

Fintech companies have been able to grow quickly and offer increasingly sophisticated services by leveraging tools built by other companies as a service. For example, companies like Venmo, Robinhood, and Transferwise need to be able to connect to their users’ bank accounts and instead of each company repeating the same, time intensive bank integration work themselves they chose to use Plaid’s unified API to be compatible with all banks via a single integration. In other words, Plaid offers bank compatibility as a service so Fintech companies can focus on their go to market and serving their customer’s needs. Fintech now has a robust infrastructure market with companies offering many key functions as a service.

In a 2019 presentation on the state of Fintech, Andreessen Horowitz partner Angela Strange provides examples of how Fintech’s infrastructure companies offer pieces of the financial stack as a service to support the Fintech industry.

As Strange illustrates, the developers of apps such as Venmo, Betterment, Blend, Earnin, Transferwise, and American Express save time, money and resources using an infrastructure such as Plaid’s and Stripe’s APIs to connect financial information from thousands of banks, accounts and end-users to enable their technology and tools.

This helps Fintech companies build better products faster, and it also helps companies not directly involved in finance participate in Fintech. Apple launching a credit card is an excellent example of how any company can now offer their own Fintech services.

How do Agtech companies use existing services to build better products and get to market faster? What will Agtech infrastructure look like in the future? How robust does Agtech infrastructure need to be for Apple to launch an agriculture-related product?

Leaf’s API Provides a Solid Foundation for Agtech.

Similar to Plaid in Fintech, Leaf’s unified API helps Agtech companies become instantly compatible with all major agriculture APIs so they can focus their full effort on building value for their customers without needing to worry about the complicated and time-consuming challenges of data integration, file translation, standardization, and ongoing maintenance.